Tech is Still the Most Important Sector, But Another One Should Outperform No Matter Where the Market Goes Into Year-end

A key breakout in one sector should lead to a nice period of outperformance

Important note: This week’s weekend piece is being sent out a day early (Friday morning) because I’ll be traveling to a wedding. Since it’s coming before the week is complete, this edition will be an abbreviated one. Also, we have Thanksgiving next week, so there will be no weekend piece next weekend…unless we have some very significant developments. (We will be sending out some daily pieces early in the week.)………Thank you very much and have a great Thanksgiving holiday!

Table of Contents:

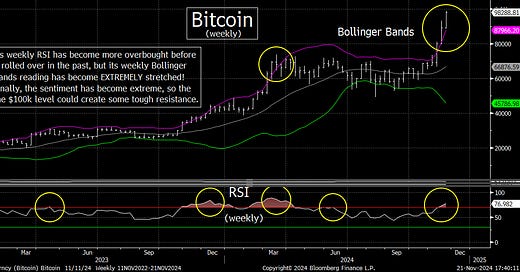

1) NVDA’s reaction to its earnings was disappointing but not horrible…..Bitcoin is extremely overbought & over-loved near-term.

2) A year-end “melt-up” is still a possibility for the stock market.

3) The energy ETFs have seen a very strong breakout move, so they’re poised to outperform going forward

4) The situation in the Middle East still has our attention…more than the war between Russia & Ukraine.

5) Despite all the talk about a “broadening out” move, the tech stocks are still THE most important sector.

6) Potpourri….Is the natural gas ETF finally going to break its KEY resistance level???

7) Summary of our current stance.

Keep reading with a 7-day free trial

Subscribe to The Maley Report to keep reading this post and get 7 days of free access to the full post archives.